As if a shrinking audience of traditional viewers and advertisers pulling back in a wobbly economy weren’t enough, TV networks will have to confront picket lines of striking writers this week as they present their fall lineups to media buyers.

The annual ritual, known as the upfronts, is when major networks like ABC and NBC sell much of their commercial inventory for the coming TV season. The networks typically take over landmark New York City venues and trot out their biggest stars for previews of their shows. The networks staged in-person upfronts in 2022 after two years of virtual presentations during the pandemic.

But the strike by the Writers Guild of America that started on May 2 will put a damper on the festivities. Many stars won’t cross pickets lines to attend the events. And the networks will be pitching shows they might not be able to deliver when the new season starts in September.

“The timing of the strike obviously with the upfronts next week creates some sort of hesitancy,” Fox Corp. Chief Executive Officer Lachlan Murdoch said on a conference call with investors last week. “It’s hard to present an exact schedule, right, if you’re only in entertainment.”

Netflix Inc., which planned to host its first-ever upfront presentation in-person at the Paris Theater on May 17, has shifted to a virtual event instead. Elon Musk announced last week that NBCUniversal’s Linda Yaccarino will be Twitter’s next CEO, leaving the media giant without its longtime head of ad sales just days before its presentation to marketers at Radio City Music Hall tomorrow.

Walt Disney Co. isn’t saying whether ABC late-night host Jimmy Kimmel will attend its presentation. In years past, Kimmel has delivered a biting monologue at the company’s event.

Rita Ferro, who heads Disney’s advertising business, said the company’s presentation, which will be held May 16 at the Javits Center, will still showcase the breadth of the company’s offerings, from Disney+ movies to ESPN sports programming.

“You’ll see all of that,” Ferro said in an interview. “Some surprises and light moments, great talent. We wish we could have more, but we’re very respectful of what’s happening in the creative community.”

The streaming giant introduced its $8-a-month, ad-supported plan for Disney+ in December, and that’s expected to be a focus of its presentation.

The TV ad business is suffering from cyclical and secular trends. Traditional TV continues to lose viewers, as customers cancel cable-TV subscriptions and watch more programming on Netflix and other streaming services. At the same time, a shaky economy has crimped ad budgets in major categories such as consumer products and finance.

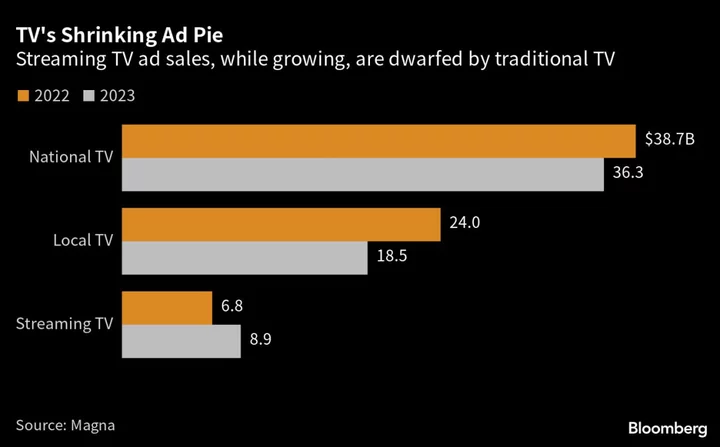

Advertising on national TV networks in the US is expected to decline 6.3% this year from 2022’s $38.7 billion, according to Magna Global. While commercials on streaming is a growth business, it’s still small. Magna projects revenue of about $8.9 billion this year.

Ironically declining traditional TV ratings could force advertisers to spend more in the upfront period because purchases are based on how many viewers are reached, and those eyeballs might not available later in the year, said Brian Wieser, a longtime analyst of the business.

“Television, for all its downward trends, is still one of the most impactful platforms for the world’s largest advertisers,” he said.

The media giants now sell ads across their various channels, with an emphasis online. Fox plans to put its free, ad-supported Tubi streaming service at the center of its upfront presentation tomorrow. Warner Bros. Discovery Inc. is working with digital ad technology companies such as EDO and LoopMe help prove to advertisers the effectiveness of their campaigns.

Such companies can track how many online searches a product gets after an ad runs, according to Jon Steinlauf, chief of US advertising sales at Warner Bros., which is holding its presentation on May 17 at Madison Square Garden. Max, the new name of the company’s HBO Max service, has a $10-a-month ad-supported subscription that will be featured at the event.

In what may turn out to be brilliant stroke of planning, Paramount Global, the parent of CBS, MTV and other networks, decided late last year not to host its regular upfront presentation at Carnegie Hall in favor of more personal outreach.

The company held private events over the past few weeks with advertisers in Chicago, New York and Los Angeles, some of them featuring stars like Neil Patrick Harris and Drew Barrymore who would be unlikely to cross picket lines this week.

“We did the heavy lifting in April,” said Jo Ann Ross, Paramount’s ad sales chief. “It’s a good position to be in.”